Buyer Agency

Buying a home is the largest investment that most people will ever make. Having the Nick Bellmore Team on YOUR side is a very smart move. Here are the Top 5 Benefits of Having a Nick Bellmore Team member as a Buyer's Agent represent you in the purchase of your next home:

1. Full Representation- As a buyers agent, we owe 100% of our dedication and loyalty to you, the home buyer. We do not have a reason or motivation to "sell" one house over another, and can thoroughly put YOUR interests above any sellers' wants or needs.

2. No Loyalty to Home Sellers or Listing Agents- Because of our 100% loyalty to you, our Buyer Client, a Buyers Agent does not need to look out for the best interests of the Seller, whatsoever. Our job is to get YOU - the Home Buyer, into the best home for the least amount of money and hassle possible. The Sellers' and the Listing Agents' wants and needs have nothing to do with the level of service provided by a Buyers' Agent to you, our Buyer Client.

If you were interested in a home, as an unrepresented buyer (no Buyer's Agent) that is listed by another agent, the only duty that the listing agent has is to not lie to you. That is it. They owe nothing else to you. They are not on your side. When you arm your self with a Buyer's Agent, you will have someone working hard for YOU at every point in the home buying process.

3. Great Knowledge of the Market- The Nick Bellmore Team knows "what is out there" better than anyone else. We spend much of our time looking at houses (both online and in person) and fully understand what is available and where all the good deals are. We are the ones setting appointments and viewing hundreds of homes every month. In many cases, we have already seen a home that you may be interested in, and can share with you many details before you even go inside!

4. Access to ALL Available Properties- The Nick Bellmore Team can show you ANY property that is available - regardless of the sign in the yard. We have access to every home that is for sale, the minute it becomes available, and have no loyalty to one listing agent or company over another. Also, in many cases we can effectively represent our buyer clients in the purchase of a home from an unrepresented seller (FSBO). Nick's team of Professional Buyers Agents will leave no stone unturned when finding the perfect home for you, my Buyer Client.

5. Effective Negotiating Skills and Contract Knowledge - As a buyers agent, The Nick Bellmore Team are trained to be effective, aggressive negotiators. One main part of their job is to write solid offers that get you, the Buyer Client in the best possible situation. They negotiate and write contracts for a living and knows all the tips and tricks to use and avoid when dealing with different listing agents and sellers. Our Buyer's Agents thoroughly understand all the details of a Buy-Sell Contract, and are able to explain and walk through the entire contract, disclosures and any counter offers to you, the Buyer Client, in a way that actually makes sense. We will maintain the contract and all necessary dates, making sure that it all works out in YOUR BEST INTEREST. Furthermore, The Nick Bellmore Team can help you find competent lenders, home inspectors, landscapers and anyone else that you, a future homeowner, may need, once you find a home that you want to buy.

BONUS BENEFIT ... In most cases, representation by a Nick Bellmore Team member will cost you nothing -It's FREE! The compensation that a Buyer's Agent receives is built into the selling costs paid by the Seller at the time of closing. WOW Cha Ching!!!

1. Full Representation- As a buyers agent, we owe 100% of our dedication and loyalty to you, the home buyer. We do not have a reason or motivation to "sell" one house over another, and can thoroughly put YOUR interests above any sellers' wants or needs.

2. No Loyalty to Home Sellers or Listing Agents- Because of our 100% loyalty to you, our Buyer Client, a Buyers Agent does not need to look out for the best interests of the Seller, whatsoever. Our job is to get YOU - the Home Buyer, into the best home for the least amount of money and hassle possible. The Sellers' and the Listing Agents' wants and needs have nothing to do with the level of service provided by a Buyers' Agent to you, our Buyer Client.

If you were interested in a home, as an unrepresented buyer (no Buyer's Agent) that is listed by another agent, the only duty that the listing agent has is to not lie to you. That is it. They owe nothing else to you. They are not on your side. When you arm your self with a Buyer's Agent, you will have someone working hard for YOU at every point in the home buying process.

3. Great Knowledge of the Market- The Nick Bellmore Team knows "what is out there" better than anyone else. We spend much of our time looking at houses (both online and in person) and fully understand what is available and where all the good deals are. We are the ones setting appointments and viewing hundreds of homes every month. In many cases, we have already seen a home that you may be interested in, and can share with you many details before you even go inside!

4. Access to ALL Available Properties- The Nick Bellmore Team can show you ANY property that is available - regardless of the sign in the yard. We have access to every home that is for sale, the minute it becomes available, and have no loyalty to one listing agent or company over another. Also, in many cases we can effectively represent our buyer clients in the purchase of a home from an unrepresented seller (FSBO). Nick's team of Professional Buyers Agents will leave no stone unturned when finding the perfect home for you, my Buyer Client.

5. Effective Negotiating Skills and Contract Knowledge - As a buyers agent, The Nick Bellmore Team are trained to be effective, aggressive negotiators. One main part of their job is to write solid offers that get you, the Buyer Client in the best possible situation. They negotiate and write contracts for a living and knows all the tips and tricks to use and avoid when dealing with different listing agents and sellers. Our Buyer's Agents thoroughly understand all the details of a Buy-Sell Contract, and are able to explain and walk through the entire contract, disclosures and any counter offers to you, the Buyer Client, in a way that actually makes sense. We will maintain the contract and all necessary dates, making sure that it all works out in YOUR BEST INTEREST. Furthermore, The Nick Bellmore Team can help you find competent lenders, home inspectors, landscapers and anyone else that you, a future homeowner, may need, once you find a home that you want to buy.

BONUS BENEFIT ... In most cases, representation by a Nick Bellmore Team member will cost you nothing -It's FREE! The compensation that a Buyer's Agent receives is built into the selling costs paid by the Seller at the time of closing. WOW Cha Ching!!!

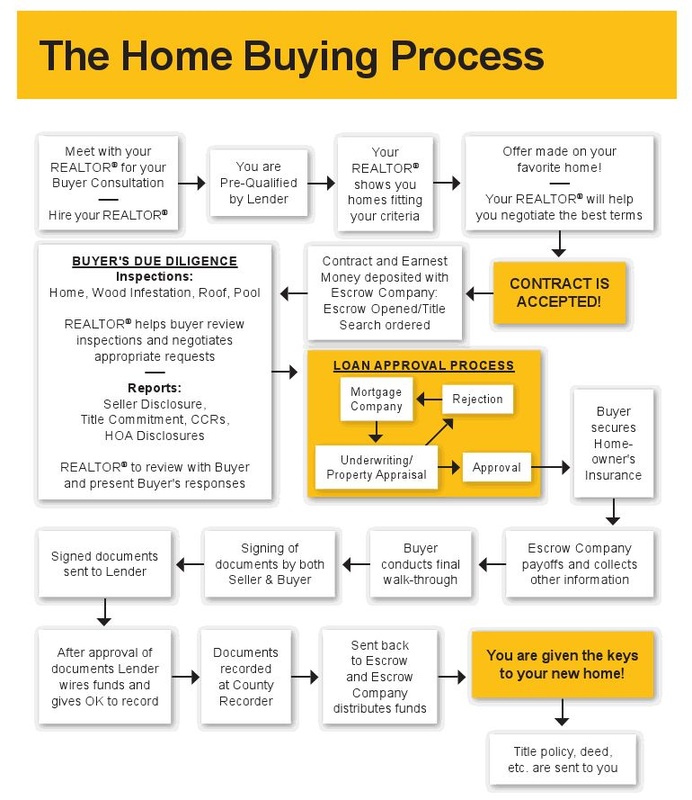

Understanding The Buying Process

Buying a home can be one of the biggest purchases you will ever make; therefore, it’s especially important that you are familiar with the home buying process to get the most out of your journey into a new home. Here are three basic steps in the home buying process:

1. Getting A MortgageSecuring Your Home Financing

In order to secure the right type of mortgage for you, it’s beneficial to know how much house you can afford. Becoming buried in a mortgage can take away the great feeling of living in your dream home very quickly. In order to secure financing, be prepared to provide a lender with the following information:

The Downpayment

If you can afford it, a downpayment of 20% or more will keep you from being required to purchase private mortgage insurance (PMI), which can run anywhere from $45 to as high as $60 per $100,000 in purchase price. While avoiding PMI might seem beneficial, if a 20% or higher downpayment puts you at risk for defaulting on your loan it’s not worth it – only pay the downpayment amount you are comfortable with and know you can afford.

2. Finding a LenderIt’s essential to get the best deal possible on loan terms, interest rates, and fees. Making a bad loan agreement can have large consequences down the road and result in you paying much more than necessary.

Consider getting pre-approved. While pre-approval is not a mortgage commitment or guarantee, getting the pre-approved will allow you to know what you can afford to spend on a new home and also distinguishes you as a serious buyer.

3. Choosing Your HomeKnow what you are looking for in a new home before you begin your search as it’s easy to become overwhelmed when viewing a potential home.

1. Getting A MortgageSecuring Your Home Financing

In order to secure the right type of mortgage for you, it’s beneficial to know how much house you can afford. Becoming buried in a mortgage can take away the great feeling of living in your dream home very quickly. In order to secure financing, be prepared to provide a lender with the following information:

- Employment status and history

- Savings information

- Current gross income

The Downpayment

If you can afford it, a downpayment of 20% or more will keep you from being required to purchase private mortgage insurance (PMI), which can run anywhere from $45 to as high as $60 per $100,000 in purchase price. While avoiding PMI might seem beneficial, if a 20% or higher downpayment puts you at risk for defaulting on your loan it’s not worth it – only pay the downpayment amount you are comfortable with and know you can afford.

2. Finding a LenderIt’s essential to get the best deal possible on loan terms, interest rates, and fees. Making a bad loan agreement can have large consequences down the road and result in you paying much more than necessary.

Consider getting pre-approved. While pre-approval is not a mortgage commitment or guarantee, getting the pre-approved will allow you to know what you can afford to spend on a new home and also distinguishes you as a serious buyer.

3. Choosing Your HomeKnow what you are looking for in a new home before you begin your search as it’s easy to become overwhelmed when viewing a potential home.

- Satisfy your curiosity. Ask as many questions as you can and keep notes about each property you visit.

- Know the area. Research the area surrounding a home you are thinking of purchasing from the local schools to the grocery store and local restaurants.

Should I Buy Now??

YES! AND HERE ARE 5 REASONS WHY....

1.) Prices Are on the Rise The latest Case Shiller Home Price Index revealed that home prices have appreciated 5.5% over the last year. This is occurring across the nation as increases were reported in 19 of 20 metros. The Home Price Expectation Survey, which polls a distinguished panel of over 100 economists, investment strategists, and housing market analysts, calls for continued appreciation over the next five years.

2.) Mortgage Interest Rates Are Expected to Increase The Mortgage Bankers Association has predicted that, after reaching record lows in 2012, mortgage rates will creep up slowly in 2013 to 4.4%. Rates have already increased by 2/10 of a point (3.32 to 3.53) in the last two months.

3.) Rents Are Continuing to Skyrocket Recently, Zillow reported that rents in the U.S. increased by 4.2% over the last year. Increases were 5% or more in many major metropolitan areas including Chicago, Boston, San Francisco, Detroit, Baltimore, Denver, San Jose and Charlotte.

4.) New Mortgage Regulations Will Be Announced Later This Year Six regulators, including the Department of Housing and Urban Development, the Office of the Comptroller of the Currency and the Securities and Exchange Commission, are currently drafting the new Qualified Residential Mortgage (QRM) rule. They will decide on two major requirements for buyers looking to qualify for a mortgage: minimum down payment and minimum FICO score. Many experts believe the new rules will be more stringent than current requirements.

5.) Timelines Will Be Shorter The dramatic increase in transactions caused many challenges to the process of buying or selling a home in 2012. We waited for inspections, dealt with last minute appraisals and prayed that the bank didn’t ask for ‘just one more piece of paper’ before issuing a commitment on the mortgage. There are fewer transactions this time of year. That means that timetables on each component of the home buying process will be friendlier for those involved in transactions over the next 90 days.

These are five good reasons why you should consider buying a home today instead of waiting. Call Nick 616-920-1809

1.) Prices Are on the Rise The latest Case Shiller Home Price Index revealed that home prices have appreciated 5.5% over the last year. This is occurring across the nation as increases were reported in 19 of 20 metros. The Home Price Expectation Survey, which polls a distinguished panel of over 100 economists, investment strategists, and housing market analysts, calls for continued appreciation over the next five years.

2.) Mortgage Interest Rates Are Expected to Increase The Mortgage Bankers Association has predicted that, after reaching record lows in 2012, mortgage rates will creep up slowly in 2013 to 4.4%. Rates have already increased by 2/10 of a point (3.32 to 3.53) in the last two months.

3.) Rents Are Continuing to Skyrocket Recently, Zillow reported that rents in the U.S. increased by 4.2% over the last year. Increases were 5% or more in many major metropolitan areas including Chicago, Boston, San Francisco, Detroit, Baltimore, Denver, San Jose and Charlotte.

4.) New Mortgage Regulations Will Be Announced Later This Year Six regulators, including the Department of Housing and Urban Development, the Office of the Comptroller of the Currency and the Securities and Exchange Commission, are currently drafting the new Qualified Residential Mortgage (QRM) rule. They will decide on two major requirements for buyers looking to qualify for a mortgage: minimum down payment and minimum FICO score. Many experts believe the new rules will be more stringent than current requirements.

5.) Timelines Will Be Shorter The dramatic increase in transactions caused many challenges to the process of buying or selling a home in 2012. We waited for inspections, dealt with last minute appraisals and prayed that the bank didn’t ask for ‘just one more piece of paper’ before issuing a commitment on the mortgage. There are fewer transactions this time of year. That means that timetables on each component of the home buying process will be friendlier for those involved in transactions over the next 90 days.

These are five good reasons why you should consider buying a home today instead of waiting. Call Nick 616-920-1809